Copper Market News: Decoding Long-Term Patterns

Updated March 31, 2024

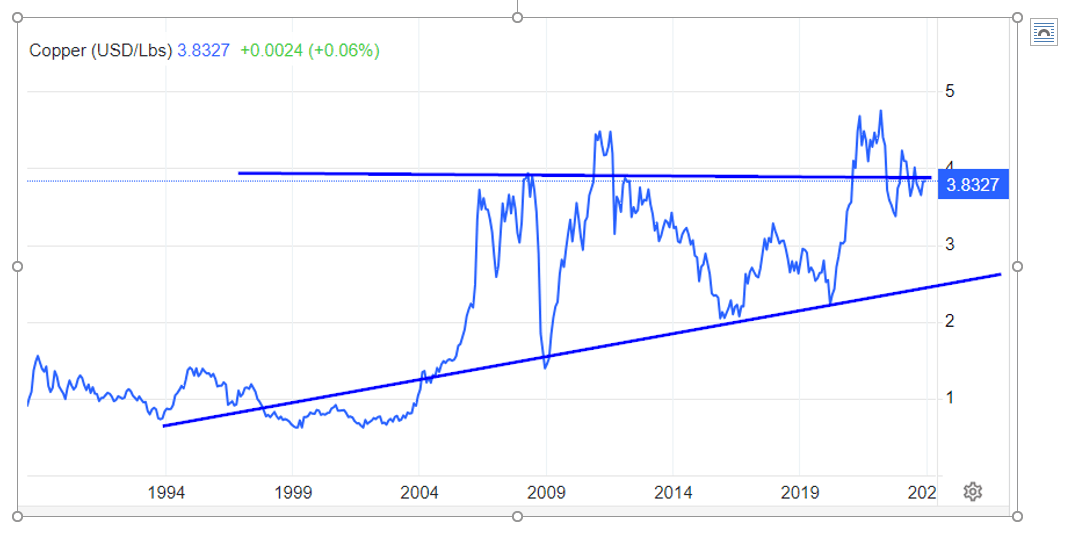

This chart reinforces and validates our primary perspective: that, from a long-term standpoint, market crashes present buying opportunities. Similar to the Dow utilities, and possibly even more prominently, copper is a leading indicator for both upward and downward movements. The long-term trend depicted in this chart highlights copper’s consistent upward trajectory, suggesting that unless it falls below 1.90, it remains within its long-term trend line. Until such a deviation occurs, the approach remains to “buy the crash and disregard the alarms of thrash.”

Shifting focus to more crucial aspects, a new bull market typically commences when surpassing old highs and concludes when the price doubles from the breakout point. In the case of copper since 2009, breakouts occurred in 2011, 2021, and 2022, yet the price failed to double after each breakout—the breakout point hovers around the 3.80 to 3.90 range. To complete the next bullish cycle, copper must trade at approximately 7.60. A weekly close at or above 3.90 should signal higher prices, and if we see a monthly close at 4.20, it will ignite a significant upward momentum, setting the stage for a test of the 6.50 plus range.

Anticipating the Supply-Demand Gap in Copper: A Long-Term Opportunity

The copper market is poised for a significant supply-demand imbalance in the coming years, creating an opportune time to establish a strategic position in this essential metal. This section should be placed after the introduction, where the long-term outlook for copper is discussed.

The projected deficit in copper supply is not a temporary phenomenon but a long-term trend driven by the exponential growth of key industries. Electric vehicle (EV) production and the shift towards renewable energy solutions are the primary drivers of this demand surge. According to the World Bank, EV production is estimated to increase thirtyfold by 2030, translating into a 1.9% annual growth in copper demand. This demand is further amplified by the expansion of renewable energy infrastructure, as copper is a critical component in solar, wind, and other sustainable energy systems.

The supply side, however, faces challenges. Opening new mines is a time-consuming process, often taking years, and existing mines are facing production constraints. This dynamic was highlighted by Robin Griffin, Vice President of Metals and Mining at Wood Mackenzie, who predicted severe copper shortages until 2030, with a potential deficit of up to 10 million tons.

The International Copper Study Group’s forecast of a 510,000 metric tonne deficit by 2024 is just the beginning. Other industry analysts predict even larger shortfalls, with Citigroup estimating an annual supply deficit of 4.7 million metric tons by 2030. This massive gap between supply and demand is expected to keep copper prices elevated and could potentially slow down the pace of the energy transition if not addressed promptly.

The current market dynamics present a unique opportunity for investors. With copper prices projected to double in the coming years, establishing a base position now could prove to be a prudent strategy. This approach aligns with the long-term outlook presented in the essay, where copper’s consistent upward trajectory is expected to continue.

Leveraging Mass Psychology and Technical Analysis for Timing Copper Market Entries

Mass psychology and technical analysis are powerful tools for timing entries into the copper market. Understanding the sentiment and emotions driving the market can help identify oversold conditions and potential buying opportunities. Mass psychology, a concept rooted in the study of crowd behaviour, influences how investors react to market events and news. By recognizing prevailing emotions, investors can make more informed decisions.

For example, during a market correction or period of negative news, investors may exhibit fear and anxiety, leading to a rush to sell. This herd behaviour can result in an oversold market, presenting a buying opportunity for those who recognize the emotional drivers. Technical analysis provides tools to identify these moments.

Moving averages, such as the simple moving average (SMA) or exponential moving average (EMA), help smooth out price data and identify potential support or resistance levels. When prices correct and approach these moving averages, it often indicates a potential buying opportunity. For instance, during the 2020 market crash driven by pandemic fears, the copper price corrected towards its 200-day SMA, presenting a strategic entry point for long-term investors.

Additionally, oscillators like the Relative Strength Index (RSI) and Stochastic RSI can identify oversold conditions. During the same 2020 crash, the RSI for copper dipped below 30, indicating an oversold market. This signal, combined with the SMA support, would have provided a compelling case for a timely entry.

Another valuable tool is the Moving Average Convergence Divergence (MACD) indicator, which identifies trend changes and potential buy or sell signals. During market corrections, a MACD crossover below zero, followed by a crossover above zero, often signifies a shift from bearish to bullish momentum, presenting another strategic entry point.

By combining mass psychology and technical analysis, investors can time their entries effectively, taking advantage of market sentiment to make profitable investments. It aligns with the contrarian approach of “buying the crash” and capitalizing on opportunities presented by pessimistic sentiment.

Conclusion: Unlocking the Potential in Commodities

In conclusion, while Bitcoin and AI stocks capture the limelight, a quiet revolution is unfolding in the commodities market, with copper, coal, and uranium presenting compelling investment opportunities. The narrative of supply-demand dynamics, coupled with the lengthy timelines required for mine development, underscores the potential for a significant mega-trend in these unsung heroes of the investment world.

The impending surge in demand for copper, driven by the rapid growth of electric vehicles and renewable energy solutions, cannot be overstated. With a projected thirtyfold increase in EV production by 2030, copper’s role as a critical component in these industries ensures its prominence in the years to come. The supply-demand gap is further accentuated by the time-intensive process of opening new mines, creating a perfect storm for price elevation and potential supply constraints.

Similarly, coal and uranium, despite the global push for cleaner energy sources, remain integral to the energy mix. The International Energy Agency forecasts a rise in global coal consumption, while the increasing adoption of nuclear power by countries like China and India underscores the relevance of uranium. These commodities, often overlooked by the masses, present opportunities for savvy investors who recognize their enduring value.

As Warren Buffett wisely advised, “Be fearful when others are greedy and greedy when others are fearful.” The mass psychology of the market has led to a fascination with cryptocurrencies and AI, but it is in the overlooked sectors that prudent investors may find their edge. The time is indeed ripe to explore and capitalize on these commodities, with copper taking the lead in this unfolding mega-trend.

Tasty Titbits

Unlocking Value in Equal-Weighted Index Funds: Benefits and Strategies

Active vs Passive Investors – The Power of Discipline

Investing allows you to beat inflation and maintain the purchasing power of your money over time

OVV Stock Forecast: Buy, Hold, or Sell?

What Does a Death Cross Mean in the Stock Market? Exploring Its Significance

Financial Freedom Book: A Pinch of Salt, a Splash of Whiskey

Unveiling Secrets: Technical Analysis for Dummies

The Primary Purpose of Portfolio Diversification is to Finesse Your Investments for Optimal Returns

The Enduring Reign: Why is the US Dollar the World’s Most Pre-eminent Currency?

Dogs of the Dow ETF: BiggerBite, Less Work

How Do You Win the Stock Market Game? Effective Strategies

Technical Analysis of Trends: Cracking the code

A Sophisticated Approach: Do Bonds Increase Returns When the Stock Market Crashes?

Mastering Your Finances: Why You Need to Learn How to Manage Your Money with Grace